Paid Cash To Supplier Journal Entry . with the knowledge of what happens to the cash account, the journal entry to record the debits and credits is easier. Accounts payable refers to the. paid cash for supplies example. subsequently when a payment is made to the supplier for the. For example, on march 18, 2021, the company abc purchases $ 1,000 of office supplies by. as we all know, a payment is made when we purchase a good or service on credit or cash basis. the purchase of supplies for cash is recorded in the accounting records with the following bookkeeping journal. general ledger account: journal entry for cash paid in advance is the process of the company paying cash to the supplier before receiving the goods or. Let’s assume that a company receives $500. In terms of a business, a vendor.

from mybillbook.in

general ledger account: Accounts payable refers to the. In terms of a business, a vendor. with the knowledge of what happens to the cash account, the journal entry to record the debits and credits is easier. as we all know, a payment is made when we purchase a good or service on credit or cash basis. paid cash for supplies example. Let’s assume that a company receives $500. subsequently when a payment is made to the supplier for the. the purchase of supplies for cash is recorded in the accounting records with the following bookkeeping journal. For example, on march 18, 2021, the company abc purchases $ 1,000 of office supplies by.

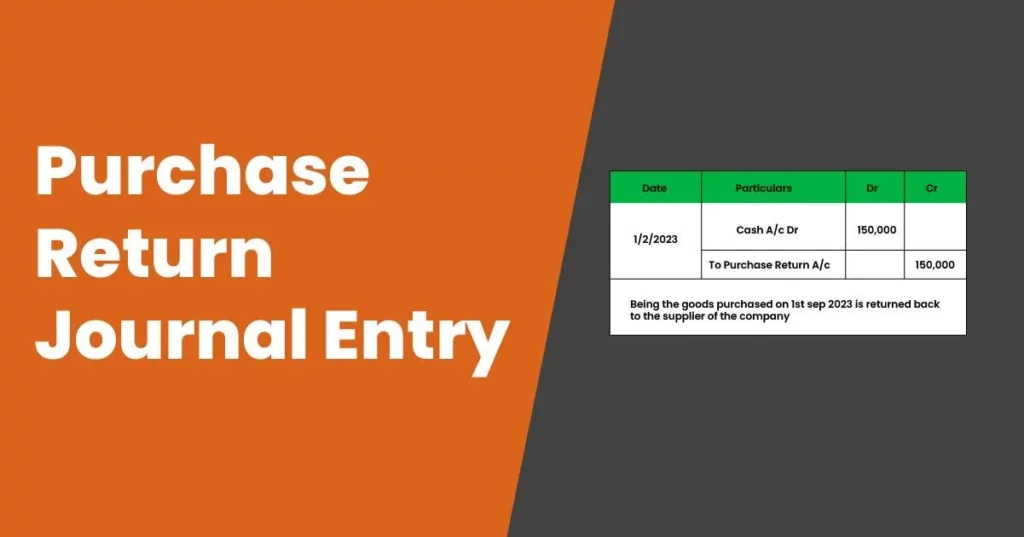

Purchase Return Journal Entry myBillBook

Paid Cash To Supplier Journal Entry subsequently when a payment is made to the supplier for the. For example, on march 18, 2021, the company abc purchases $ 1,000 of office supplies by. subsequently when a payment is made to the supplier for the. general ledger account: journal entry for cash paid in advance is the process of the company paying cash to the supplier before receiving the goods or. In terms of a business, a vendor. the purchase of supplies for cash is recorded in the accounting records with the following bookkeeping journal. Let’s assume that a company receives $500. as we all know, a payment is made when we purchase a good or service on credit or cash basis. paid cash for supplies example. Accounts payable refers to the. with the knowledge of what happens to the cash account, the journal entry to record the debits and credits is easier.

From www.carunway.com

Purchase Goods for Cash Journal entry CArunway Paid Cash To Supplier Journal Entry subsequently when a payment is made to the supplier for the. Let’s assume that a company receives $500. as we all know, a payment is made when we purchase a good or service on credit or cash basis. general ledger account: journal entry for cash paid in advance is the process of the company paying cash. Paid Cash To Supplier Journal Entry.

From www.chegg.com

Solved A journal entry for a 300 payment to purchase office Paid Cash To Supplier Journal Entry as we all know, a payment is made when we purchase a good or service on credit or cash basis. Let’s assume that a company receives $500. paid cash for supplies example. the purchase of supplies for cash is recorded in the accounting records with the following bookkeeping journal. Accounts payable refers to the. subsequently when. Paid Cash To Supplier Journal Entry.

From denorgia.blogspot.com

Discount Received Journal Entry Cash Purchase of Goods Double Entry Paid Cash To Supplier Journal Entry as we all know, a payment is made when we purchase a good or service on credit or cash basis. journal entry for cash paid in advance is the process of the company paying cash to the supplier before receiving the goods or. paid cash for supplies example. In terms of a business, a vendor. Let’s assume. Paid Cash To Supplier Journal Entry.

From www.youtube.com

Chapter 10.3 Journalizing Sales Returns and Allowances Using a General Paid Cash To Supplier Journal Entry Accounts payable refers to the. Let’s assume that a company receives $500. general ledger account: with the knowledge of what happens to the cash account, the journal entry to record the debits and credits is easier. For example, on march 18, 2021, the company abc purchases $ 1,000 of office supplies by. subsequently when a payment is. Paid Cash To Supplier Journal Entry.

From www.youtube.com

Cash Payments Journal YouTube Paid Cash To Supplier Journal Entry the purchase of supplies for cash is recorded in the accounting records with the following bookkeeping journal. general ledger account: with the knowledge of what happens to the cash account, the journal entry to record the debits and credits is easier. Let’s assume that a company receives $500. paid cash for supplies example. For example, on. Paid Cash To Supplier Journal Entry.

From biz.libretexts.org

3.5 Use Journal Entries to Record Transactions and Post to TAccounts Paid Cash To Supplier Journal Entry Accounts payable refers to the. the purchase of supplies for cash is recorded in the accounting records with the following bookkeeping journal. subsequently when a payment is made to the supplier for the. Let’s assume that a company receives $500. paid cash for supplies example. journal entry for cash paid in advance is the process of. Paid Cash To Supplier Journal Entry.

From fundsnetservices.com

Journal Entry Examples Paid Cash To Supplier Journal Entry Accounts payable refers to the. Let’s assume that a company receives $500. the purchase of supplies for cash is recorded in the accounting records with the following bookkeeping journal. For example, on march 18, 2021, the company abc purchases $ 1,000 of office supplies by. as we all know, a payment is made when we purchase a good. Paid Cash To Supplier Journal Entry.

From www.youtube.com

Journal Entry for Purchase of Inventory Professor Victoria Chiu YouTube Paid Cash To Supplier Journal Entry journal entry for cash paid in advance is the process of the company paying cash to the supplier before receiving the goods or. Let’s assume that a company receives $500. Accounts payable refers to the. general ledger account: For example, on march 18, 2021, the company abc purchases $ 1,000 of office supplies by. with the knowledge. Paid Cash To Supplier Journal Entry.

From www.youtube.com

3 Purchase goods for Cash journal entry YouTube Paid Cash To Supplier Journal Entry Let’s assume that a company receives $500. Accounts payable refers to the. paid cash for supplies example. In terms of a business, a vendor. journal entry for cash paid in advance is the process of the company paying cash to the supplier before receiving the goods or. For example, on march 18, 2021, the company abc purchases $. Paid Cash To Supplier Journal Entry.

From dxooqyxds.blob.core.windows.net

What Is Journal Entry Explain With Example at Irene Hart blog Paid Cash To Supplier Journal Entry Let’s assume that a company receives $500. journal entry for cash paid in advance is the process of the company paying cash to the supplier before receiving the goods or. general ledger account: the purchase of supplies for cash is recorded in the accounting records with the following bookkeeping journal. Accounts payable refers to the. with. Paid Cash To Supplier Journal Entry.

From solarsys.sg

Advance payment to a supplier in foreign currency Solarsys Paid Cash To Supplier Journal Entry the purchase of supplies for cash is recorded in the accounting records with the following bookkeeping journal. as we all know, a payment is made when we purchase a good or service on credit or cash basis. For example, on march 18, 2021, the company abc purchases $ 1,000 of office supplies by. subsequently when a payment. Paid Cash To Supplier Journal Entry.

From psu.pb.unizin.org

2.4 Sales of Merchandise Perpetual System Financial and Managerial Paid Cash To Supplier Journal Entry general ledger account: For example, on march 18, 2021, the company abc purchases $ 1,000 of office supplies by. subsequently when a payment is made to the supplier for the. Let’s assume that a company receives $500. the purchase of supplies for cash is recorded in the accounting records with the following bookkeeping journal. journal entry. Paid Cash To Supplier Journal Entry.

From biz.libretexts.org

9.1 Explain the Revenue Recognition Principle and How It Relates to Paid Cash To Supplier Journal Entry the purchase of supplies for cash is recorded in the accounting records with the following bookkeeping journal. Let’s assume that a company receives $500. subsequently when a payment is made to the supplier for the. paid cash for supplies example. Accounts payable refers to the. as we all know, a payment is made when we purchase. Paid Cash To Supplier Journal Entry.

From www.thevistaacademy.com

Journal entry of Advance received from Customer and advance paid to Paid Cash To Supplier Journal Entry with the knowledge of what happens to the cash account, the journal entry to record the debits and credits is easier. Accounts payable refers to the. In terms of a business, a vendor. the purchase of supplies for cash is recorded in the accounting records with the following bookkeeping journal. Let’s assume that a company receives $500. . Paid Cash To Supplier Journal Entry.

From mavink.com

Perpetual Inventory System Journal Entry Paid Cash To Supplier Journal Entry as we all know, a payment is made when we purchase a good or service on credit or cash basis. paid cash for supplies example. For example, on march 18, 2021, the company abc purchases $ 1,000 of office supplies by. with the knowledge of what happens to the cash account, the journal entry to record the. Paid Cash To Supplier Journal Entry.

From denorgia.blogspot.com

Discount Received Journal Entry Cash Purchase of Goods Double Entry Paid Cash To Supplier Journal Entry journal entry for cash paid in advance is the process of the company paying cash to the supplier before receiving the goods or. the purchase of supplies for cash is recorded in the accounting records with the following bookkeeping journal. For example, on march 18, 2021, the company abc purchases $ 1,000 of office supplies by. In terms. Paid Cash To Supplier Journal Entry.

From mybillbook.in

Purchase Return Journal Entry myBillBook Paid Cash To Supplier Journal Entry In terms of a business, a vendor. Let’s assume that a company receives $500. paid cash for supplies example. general ledger account: with the knowledge of what happens to the cash account, the journal entry to record the debits and credits is easier. the purchase of supplies for cash is recorded in the accounting records with. Paid Cash To Supplier Journal Entry.

From exopawlls.blob.core.windows.net

Sale Of Furniture Journal Entry at Dale Armstrong blog Paid Cash To Supplier Journal Entry Let’s assume that a company receives $500. For example, on march 18, 2021, the company abc purchases $ 1,000 of office supplies by. journal entry for cash paid in advance is the process of the company paying cash to the supplier before receiving the goods or. Accounts payable refers to the. general ledger account: paid cash for. Paid Cash To Supplier Journal Entry.